Quick-Switch Guide

Objective: This quick-switch guide is here to give you core information about the low-cost alternatives to mutual funds. It’s my mission and passion to teach as many Canadians as possible about low cost investing. I encourage you to InvestItForward by sharing the information below.

Average Canadian equity mutual funds charge 2.35% yearly [Source]

Save money by lowering your yearly investing fees with these options below!

click on an option below to learn more

For a deeper understanding of these alternatives and the financial industry in general I highly suggest attending my seminar events or booking a personal financial consultation.

These options are not any more difficult than the other, they just require different amounts of effort. Every single Canadian can grasp each one of these methods if they put in the time. Also, the amount of time spent is insignificant compared to the amount of money you’ll save. Depending on your saving habits and the method you choose you can save hundreds of thousands of dollars over your lifetime. (This is covered more in depth in my seminars.)

If you decide to switch there is a guide to transferring your funds at the end of this page. Transferring/switching is a similar process for all options.

Apart from the chart comparison I also have an analogy to give you another perspective on these products and how they fit with your lifestyle. Not many people can say they like investing but everyone likes cake so let’s use cake!

You can contact a bakery and order a pre-made cake: it costs more but is super-easy and all you have to do is pick it up (Tangerine). You can go to a cake warehouse but you’ll have to browse the aisles a bit more until you find what you like. This is cheaper and just about as easy (Robo-advisors). You can buy cake mix in a box which is cheaper but you’ll need a recipe and effort to create your cake (TD e-series). You can buy all the ingredients yourself and make a cake completely from scratch, which is the cheapest option but also involves the most work. (ETFs). Finally last and least: A hungry cake salesperson will double-charge you so they can get a cake for themselves! (High cost mutual funds recommended by an advisor)

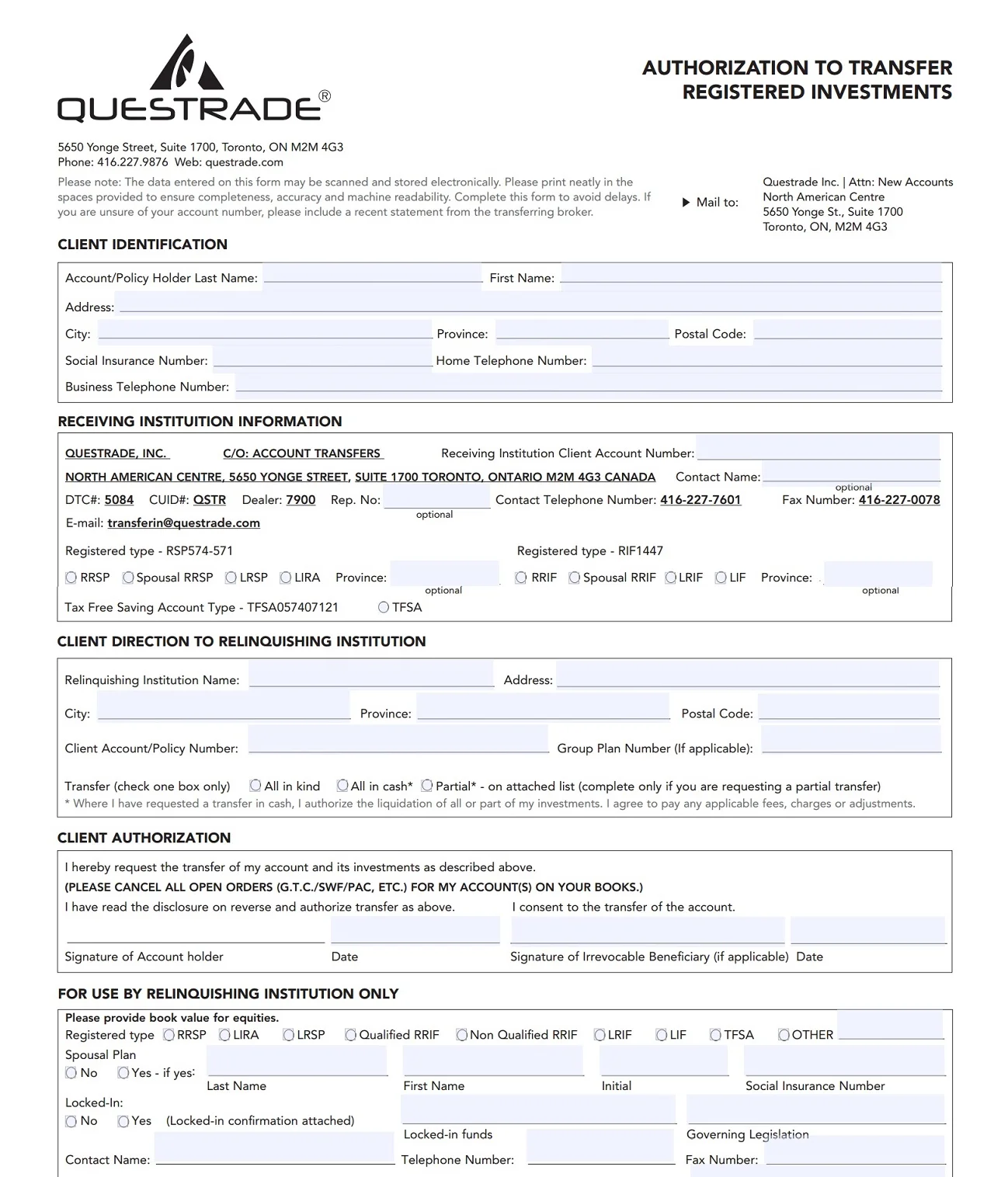

Transferring to your option of choice:

Before reading this make your decision from the options listed above. This is a process you will need to perform once you are transferring from your previous institution. In order to transfer out of an RRSP or TFSA it’s very important to use a registered transfer form. The registered investment transfer form allows you to transfer your RRSP/TFSA directly to your new quick-switch option of choice’s respective accounts without actually withdrawing. If you don’t use the transfer form and withdraw your RRSP you will be taxed. If you withdrew from your TFSA you would have to wait until next year to re-gain the contribution limit of the money withdrawn.

Using the registered transfer form avoids all of these potential issues!

On the last part of this page is an example of what the registered transfer form will look like. A few key term definitions will help too. The relinquishing institution is the firm which is currently holding your investments. Transferring “all in kind” means you are transferring the investments you already own to your new institution of choice. Transferring “all in cash” means all the investments will be sold and the cash will be transferred. I am using Questrade’s form as an example, most transfer forms are identical and should only take around 2-5 minutes to fill out.

It’s also worth noting that your previous institution which holds your mutual funds may charge a $50-150 fee for the registered transfer. All of the options I have covered above will cover the transfer out fee if your account size is large enough ($25000 is a safe estimate, $50000 is nearly guaranteed to get that fee waived). Contact your firm of choice directly to work out a deal, most are more than happy to help acquire new customers.

Even if you can’t get the fee waived, remember that the methods here are all saving you exponentially more money over the long term. A 1% difference in fund fees can save you hundreds of thousands of dollars over your lifetime.

I hope this guide acts as the first step toward achieving your personal financial goals. If this quick-switch article helped you make sure to invest it forward by sharing it!

-Michael Boyechko

*Do not print this example, your institution of choice will provide you with the form.*

Question or suggestion? Contact me!